5 moments that changed bitcoin forever

Bitcoin has come a long way in just over a decade, but there have been several key milestones shaped its journey through the years. In this article, we're taking a quick look at some of those key moments and how they influenced Bitcoin's progression at a practical level.

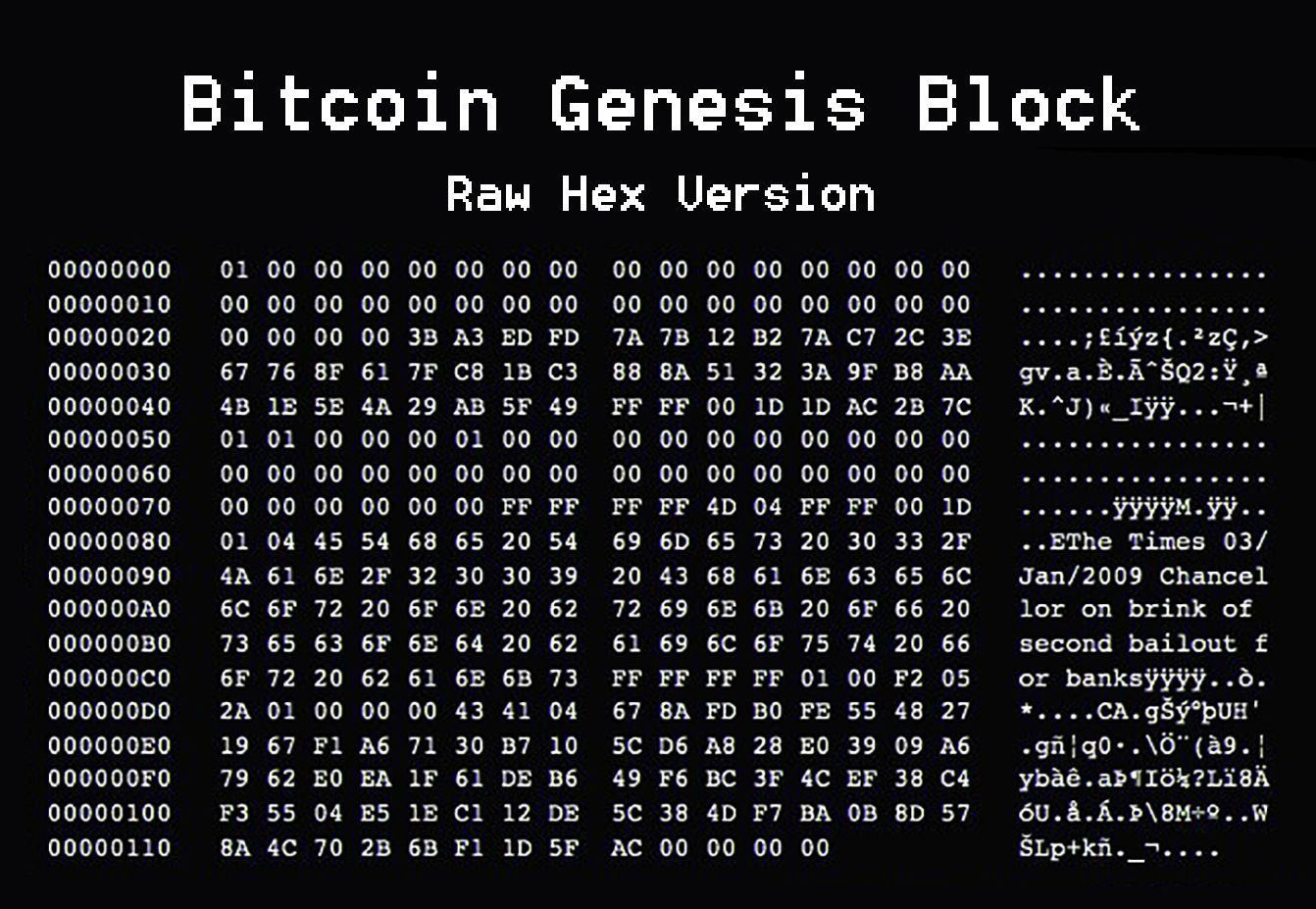

#1: The Genesis Block - January 3, 2009

With the world reeling from the 2008 financial crisis, a cypherpunk who went by the name of Satoshi Nakamoto mined the first block in the Bitcoin blockchain, known as the genesis block.

Impact: Though Satoshi previously announced his intentions in a whitepaper sent to a cypherpunk mailing list, the genesis block served as the moment Bitcoin transitioned from a thought experiment or academic exercise to a live protocol. The world's first viable cryptocurrency had begun.

#2: P2SH Activation - Spring 2012

In the early years of bitcoin, it was easy to lose funds. Off-the-shelf hardware wallets didn't exist yet. Unless they had technical knowledge about complex scripts, bitcoiners were far more likely to protect their funds with a single key, which left vulnerable to hacks and accidental loss.

Pay-to-Script-Hash (P2SH) allowed users to more easily leverage multisig, a setup that protects bitcoin with multiple private keys. The Bitcoin network enabled P2SH transactions in a soft fork that took place around March 2012, a notable milestone nearly a year after Satoshi's disappearance.

Impact: Bitcoin needed secure storage capability and a life of its own to succeed as a store of value. P2SH brought much-needed stability to Bitcoin's user experience and paved the way for digital sovereignty...and for Casa!

#3: Mt. Gox Collapse - February 2014

The bitcoin network is more than just software. The human network of bitcoiners plays a crucial role in how Bitcoin evolves. Bitcoiners learned a costly lesson in February 2014 when popular Bitcoin exchange Mt. Gox filed for bankruptcy.

An estimated 850,000 bitcoin was lost — nearly 7% of the total bitcoin supply at the time. The exchange went offline, preventing bitcoiners from withdrawing their bitcoin. About 200,000 bitcoin was recovered, but creditors would have to wait in line for years before they could reclaim their funds.

Impact: Not your keys, not your bitcoin. If an exchanges hold the private key to your bitcoin, it isn't really yours. The sting of Mt. Gox lives on in the bitcoin community as a reminder to take ownership of your money.

#4: The Blocksize War - 2015 to 2017

Bitcoin is hard to change by design. As long as you adhere to the protocol rules, you can run any software you want and participate in the Bitcoin network. If you break the rules, the network rejects your transactions.

That concept was put to the test in the mid-2010s. A harsh debate developed over how to scale Bitcoin, specifically the amount of data that could be processed in each block.

On another level, the debate revealed disagreement over bitcoin's primary function. Small blockers preferred an airtight store of value. Big blockers preferred a more nimble medium of exchange. Many big blockers eventually channeled their frustrations into creating hard forks of Bitcoin that resulted in other blockchains, all of whom failed.

Eventually, the bitcoin network activated SegWit, a soft fork with scalability improvements.

Impact: While technical, the blocksize debate cemented Bitcoin's reputation as a robust network resistant to change and proved no single entity controls Bitcoin. Network consensus continues to be debated to this day.

#5: Taproot Activation - November 2021

Bitcoin upgrades don't necessarily have to be contentious. Taproot, the first network upgrade since SegWit, was activated in November after years of careful vetting from bitcoin developers.

Taproot provides the network with privacy and scaleability improvements, such as lower transaction fees and Schnorr signatures, which make it harder to differentiate between single-sig and multisig wallets.

Impact: It's often said in tech that you should "move fast and break things." That couldn't be further from the truth with bitcoin. When you're securing a network with more than $500 billion in value, you need to tread carefully. The Taproot upgrade proved network upgrades are possible with broad technical consensus.

Check out the below article for a more in-depth explainer of how Taproot works.

Have peace of mind about your bitcoin

Do you wonder if your bitcoin is safe on an exchange? Custodians and exchanges are single points of failure when it comes to securing your bitcoin. If anything happens to them, your bitcoin could be at risk.

Casa allows you to upgrade your bitcoin security, beginning with holding your private keys. With this setup, you can relax knowing your bitcoin safe.

Learn more here.