It’s time to lowercase bitcoin

Language is technology. Like bitcoin, it’s a trustless, peer-to-peer system that allows us to establish consensus and convey value with one another. And like all systems, it can be optimized.

Up to now, the prevailing trend within the varying stakeholders in the bitcoin community — companies, media outlets, and users — has been to capitalize “Bitcoin” when referring to the network or the system at large and lowercase “bitcoin” when referring to payments and the currency itself.

At Casa, we’re constantly searching for ways to deliver a smooth user experience for everyone. We believe the traditional capitalization rule is no longer necessary, creates confusion, and is a hindrance for education, and we propose lowercasing bitcoin as a better alternative. Here is our rationale behind this suggestion.

Out with the old

– The Associated Press Stylebook (55th Edition)

When new things come along, it makes sense to handle them with care. Every day, we encounter any number of trends, ideas, and memes. If anything, the pace at which people and ideas break the internet and fade into obscurity seems to be quickening in the 21st century.

Capitalization is part of how we recognize the unfamiliar. In the English language, capitalization is generally reserved for proper nouns, such as persons, places, organizations, and other living things.

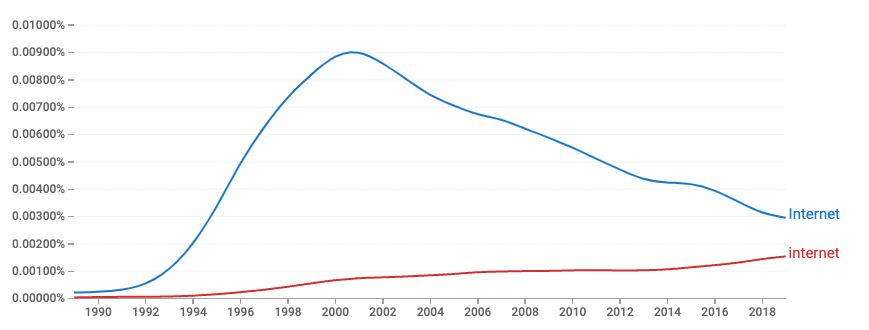

Our relationship with technology is more immediate, and elements we rely upon everyday are usually represented in lowercase: fire, electricity, cars, lightbulbs, computers, phones, internet, email, tweets. All these discoveries and inventions were new at one point but reached a critical mass of adoption to make them a regular part of everyday communications. We believe bitcoin is at this inflection point.

In with the mainstream

Bitcoin is more than a meme. Memes don’t last 13 years, and they don’t grow to secure a trillion dollars in value. Other key milestones have taken place since 2020 alone:

- An estimated 16% of Americans have used, traded, or invested in some form of cryptocurrency, according to Pew Research Center

- An estimated 176 million people own bitcoin around the world, according to crypto.com

- A nation has named bitcoin legal tender (El Salvador)

- Publicly traded companies hold bitcoin on their balance sheet

The story about bitcoin isn’t about price, volatility, or whether it’s “dead” as many have tripped over themselves to declare. The story is that we are living in an increasingly digital world that isn’t going away. And while the world accepts that inevitability with social media, streaming, and any number of apps and gadgets, the media has buried the lede when it comes to bitcoin by treating it like a foreign object.

Practically speaking, it’s time for a reset. We don’t capitalize dollars, commodities, land, stocks, or bonds. The perceived need to capitalize bitcoin is derived from a fundamental misunderstanding of how bitcoin works.

The network is the coin

Traditionally, capitalizing bitcoin has served to differentiate the network from the cryptocurrency itself. Bitcoin the system has been treated as separate from bitcoin the currency. This separation is confusing and misleading.

Your bitcoin resides on the network. The bitcoin protocol consists of a network of computers that maintain a ledger in cyberspace using cryptography and energy.

When you spend bitcoin on-chain, you transfer your spending ability to another party, using private keys. Everyone in the world can review your transaction and verify its authenticity because bitcoin is public and open source.

The network only exists to maintain the currency, and the currency is what incentivizes each participant to cooperate. You can’t get the currency without the network. There is simply no way to separate the two.

Furthermore, capitalizing the network and lowercasing the currency creates a massive gray area for other terms. For instance, one can simultaneously make the case for and against capitalizing bitcoin addresses under the old rule. The address exists on the network, but it’s also where you send and receive bitcoin. The same ambiguity applies to wallets, mining, and even custody, where you really secure keys.

Unwieldy rules drag a system down and make it harder to welcome billions of users. Newcomers are unaware of these nuances through no fault of their own. It’s up to us as a community to create and maintain rules we can enforce.

Simplicity reigns supreme

There is beauty in simplicity, and this is true with bitcoin. Its lean, elegant design has helped it scale to millions of users all around the world. Superior user experience has also been our calling card at Casa ever since our journey began, and we’ve strived to make bitcoin security simple for everyone.

As we move forward, education is the greatest obstacle to mass adoption. The world is waiting for us as a community to pitch bitcoin in a stable, thoughtful manner, and we believe bitcoin’s minimalist design should translate to an economy of words. Lowercasing bitcoin is a subtle change that underscores mass adoption.

Let’s work together to make bitcoin easy. Case closed.

Never worry about your bitcoin again

With Casa, you can protect your bitcoin without ever having to wonder if you're doing it right. Our multi-key vaults give you protection against hacks, exchange failures, and accidents.

Get started here.